The discussions related to the surprising tax changes introduced as part of the Polish Order have not stopped yet, and the highly advanced works related to the amendment of these provisions are already underway. The largest reform of the tax law in many years had a negative impact on the taxation of a large number of people running a business, including insurance agents.

The government decided to react to the great social dissatisfaction resulting from the Polish Deal by introducing changes aimed at eliminating some of the unfavorable regulations for entrepreneurs. The Ministry presented a number of solutions in the draft act, which were additionally supplemented after conducting public consultations. Below, we present the most important proposals from the perspective of insurance agents.

It is worth noting that this is the first such large change in PIT introduced during a tax year, and a change in the rules of settlements during the year is possible only in a situation where it is beneficial for taxpayers.

Taxation of agents after the entry into force of the Polish Deal

As a reminder, it is worth pointing out that agents running a business can choose from three taxation options, i.e .:

- the most popular flat taxation (19%),

- taxation using the tax scale (17% / 32%) and

- lump sum taxation on revenues (generally at a rate of 17% or 15%).

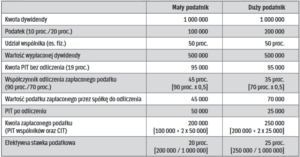

The Polish Deal has significantly modified the method of calculation and the amount of public burdens for entrepreneurs, in particular in the field of health insurance. Currently, entrepreneurs taxed on a straight-line basis pay a health insurance contribution at the rate of 4.9%, progressively taxed on income at a rate of 9%, while those taxed with a lump sum pay a flat-rate contribution depending on the income ceiling (three thresholds). In any of these variants, the health insurance contribution does not reduce taxation, although previously taxpayers had the option of deducting a significant part of the contribution from the tax.

Health insurance contribution 2.0

Of all the changes introduced as part of the Polish Order, entrepreneurs felt the most severely affected by the health insurance premium. The government decided to introduce a slight improvement and in the Polish Deal 2.0 it plans to modify the rules of accounting for health insurance contributions.

For taxpayers taxed on a linear basis, the draft provides for the possibility of including the paid health insurance as tax cost. In the tax year, the taxpayer is to be able to deduct health insurance up to PLN 8,700 from the income, and in subsequent years this amount is to be increased.

Entrepreneurs taxed on a flat rate basis will be able to reduce their income by 50% of the value of paid health insurance premiums.

Importantly, the change will apply from the beginning of 2022, and contributions paid before the entry into force of the act are also to be deductible.

Therefore, the most unfavorable change in the Polish Deal will be slightly neutralized and the health insurance premium will have a small impact on reducing taxation. However, it will not be a return to the solution binding until the end of last year, when the health insurance contribution reduced the tax, so the tax benefit was incomparably greater.

What’s next for middle class relief?

The issue that raised the most doubts among taxpayers and accountants was and still is the relief for the middle class. Despite the fact that the relief was supposed to be a positive solution, it caused more problems than benefits. Now the Ministry of Finance plans to abolish the relief for the middle class. And this is already in relation to the settlement for 2022.

Interestingly, the proposed regulations are to assure taxpayers that this change will be beneficial. If at the end of the year it turns out that in a specific case taxation with the use of the tax credit would be more favorable, it will be applied in the annual settlement. We can only hope that the proposed solution will actually work this time.

The elimination of the middle-class tax relief will apply to agents who conduct business activities subject to the tax scale and people who are employed under an employment contract.

For the same group of people, the first tax rate in the case of taxation using the tax scale will be reduced from 17% to 12%. From the taxpayer’s perspective, lowering the tax rate is undoubtedly beneficial. Importantly, the lower tax is to apply already to the settlement for 2022.

It is also worth noting that the regulations still contain favorable solutions introduced at the beginning of the year, i.e. an increase in the tax threshold to PLN 120,000. PLN and the tax-free amount up to 30 thousand. zloty.

What about the choice of taxation method?

In connection with the change in the rules of taxation of economic activities, the legislator plans to introduce the possibility of changing the taxation method in relation to 2022!

If the agents using the so-called the flat rate (19%) believe that the tax scale would be more favorable for them, in the settlement for 2022 they will be able to choose the annual settlement according to the tax scale. However, this will not result in the choice of this form of taxation for subsequent tax years, which will have to be done separately.

A similar option to choose the tax scale will be available to agents who chose flat-rate taxation at the beginning of this year. In addition, those taxed with a lump sum will have the option to resign from lump sum taxation for the remainder of the year until August 22, 2022 – then at the end of the year it will be necessary to submit two annual tax returns.

How will agents settle PIT for 2022?

Polish Deal 2.0 is to introduce regulations that are more favorable than those currently in force. As a result, at the end of the year, the amount of the fiscal burden should be lower than originally assumed, and the planning related to the selection of the best method of taxation for 2022 may in many cases be out of date.

In the annual settlement, agents will have to verify whether it will be better for them to use the tax scale settlement and, possibly, choose this form of taxation for 2022. The Ministry informs that taxpayers will be provided with advanced calculators with which they will be able to check which method billing will be better for them.

We do not know the final shape of the regulations that will apply to the settlement of agents for 2022, but the calculations made at the end of last year have become obsolete and will not be useful.

The draft amendment was approved by the Council of Ministers and is currently at the stage of work in the Seym. The amended regulations are to enter into force on July 1, 2022.