Katarzyna Zadroga

18 May 2022

Estonian CIT in practice

news

Tax

Lump sum on the income of capital companies, popularly known as the Estonian CIT, was introduced to the Polish legal system at the beginning of 2021 as an alternative form of taxation to the general rules. The first version of this model of taxation, however, was quite far from its Estonian prototype, which was to be a determinant of a pro-investment, taxpayer-friendly and maximally informal form of taxation.

Therefore, at the beginning of 2022, an amendment to the regulations came into force to convince Polish entrepreneurs to choose to tax with Estonian CIT. As part of the introduced changes, not only the name of the model has been modified, i.e. now we are talking about a lump sum on company income, but also the group of taxpayers entitled to apply the lump sum has expanded, or the requirements for the application of this preferential taxation method have been “loosened”. As a result of these changes, and in the face of increasing tax burdens in connection with the so-called In the Polish Government, the Estonian CIT is becoming an alternative taxation for Polish taxpayers worth considering. In such a situation, it is worth looking at several practical aspects of the Estonian CIT, which, although addressed in theory in the regulations, may still raise significant doubts in practice.

Starting the copmany and transformation

The CIT Act provides for two tax rates for Estonian CIT – 10%. applicable in the case of a small taxpayer and a taxpayer starting business, and 20 percent. In other cases. What about taxpayers who were established as a result of transforming, for example, a sole proprietorship into a limited liability company? or also partnerships, e.g. general partnership? In such a situation, it can be concluded that we are dealing with the commencement of business, since in practice the establishment of a company is a continuation of the economic activities carried out? The analysis of the provisions of the CIT Act relating to taxpayers starting business activity (i.e. taxpayers within the meaning of the CIT Act) and the “Guide to the lump sum on company income” published on 23 December 2021 (hereinafter: the Guide) shows that in such a situation we have to dealing with starting a business. In addition, the Guide emphasizes that the transformation of a sole proprietorship into a business start-up is not a restructuring activity listed in Art. 28k paragraph. 1 points 5-6, which would make it impossible to apply the lump sum.

As a result, entrepreneurs conducting sole proprietorship or general partnerships, after the transformation, are entitled to apply the 10% rate of Estonian CIT in the first year after the transformation.

In this case, it is worth noting that the possibility of applying the lower of the Estonian CIT rates for start-ups was introduced only under the provisions in force from January 1, 2022.

Therefore, the legislator met the expectations of entrepreneurs who can benefit from the preferential rate not only if their revenues do not exceed PLN 2 million, but also when they have just started operating in the form of a company.

Not only dividends

The key attribute of Estonian CIT is no need to tax the profit earned, and as a result, no need to pay monthly or quarterly CIT advances until its payment. The CIT Act indicates the events that will result in the obligation of the flat-rate payer to settle the tax, i.e .:

- allocating the profit earned in the period of taxation with a lump sum to be paid to shareholders (payment of dividends, but also advance payments for dividends) or to cover losses incurred before the tax period of Estonian CIT (adopting a resolution to allocate the generated profit to cover losses from previous years),

- the rise of income from the so-called hidden profits

- incurring expenses not related to the conducted activity,

- excess of the market value of the assets being acquired over the tax value of these assets (income from changes in the value of assets) – in the case of transformation of entities,

- obtaining income from the so-called undisclosed business operations.

While payments to shareholders or a surplus resulting from transformations seem to be a fairly obvious method of payment of profit, which causes the necessity to pay the tax, the definition of the so-called hidden profits. Also in this case, the legislator hurries to explain by pointing to an exemplary catalog of activities that may generate taxation as hidden profits.

And so, among these types of events, one should mention,is granting loans to partners or entities related to them, as well as benefits for private foundations or trusts and donations, including gifts and offerings of all kinds, or underestimating the market value of transactions with a related entity. It should be noted here that the list of transactions contained in the CIT Act is not exhaustive and in practice all kinds of benefits for partners, but also for their families as related entities, can be treated as income from the so-called hidden profits.

In addition, a category that raises some doubts, causing the necessity to pay the tax is also incurring expenses not related to the conducted activity. The CIT Act in no way specifies what falls into this category, although a vague explanation can be found in the Guide. According to the Guide, in the case of analyzing whether we are dealing with an expense not related to the conducted activity, it is possible to use not only the qualification of expenses as non-tax costs in accordance with Art. 15 sec. 1 of the CIT Act, but also the entity’s current practice (helpful if it was a CIT taxpayer) and court and administrative judgments. And so, as an example of expenses not related to the conducted activity, one should indicate, inter alia, interest and contractual penalties excluded from the category of tax costs pursuant to Art. 16 of the CIT Act. By the way, it is worth pointing to the case-law favorable to taxpayers in the field of contractual penalties arising in the event that breaking the contract was more economically beneficial for the taxpayer than maintaining it. As a result, despite the fact that taxpayers taxed with Estonian CIT do not recognize tax revenues and costs based on the regulations contained in Art. 15 and 16 of the CIT Act, knowledge of these regulations, but also of jurisprudence, may be crucial in the case of, inter alia, identification of expenses not related to the business activity leading to the obligation to pay the tax.

Taxation of partners

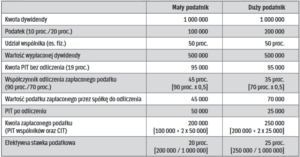

In the case of CIT taxpayers, there is double taxation of profits generated by these companies. This means that the payment of profit is taxed both at the level of the company that is a taxpayer of Estonian CIT (10% or 20% of the value of the payment, e.g. dividend) and at the level of a partner who is a natural person (19% PIT rate for revenues from capital gains). ).

At the same time, the CIT Act provides for the mechanism of deduction by the partners of the tax paid by the company from the due PIT tax. The amount of the deduction in this case depends on whether the taxpayer of Estonian CIT will have the status of a small taxpayer or not. In the case of a withdrawal from a non-small taxpayer company, the deduction ratio will be 70%. the amount of tax due to the company per shareholder, and in the case of a small taxpayer it is 90 percent. Consequently, the total taxation of profits in a small taxpayer is 20%, and in other cases 25%.

Illustrating it on a numerical example, assuming that an Estonian CIT taxpayer has two partners, each of whom has 50 percent. shares: >> see table below.

Author’s view

Katarzyna Zadroga, tax advisor, Senior Consultant at ALTO

The amendment to the regulation on lump sums from companies, which entered into force on January 1, 2022, will certainly be an incentive for Polish taxpayers looking for an alternative method of taxation, bearing in mind the unfavorable consequences of the Polish Deal, in particular for entrepreneurs operating on a smaller scale. lowering the requirements for the application of Estonian CIT or reducing tax rates may seem particularly attractive for sole proprietorships or partnerships which, due to the planned business development, will decide to operate in the form of a CIT taxpayer company. Therefore, the benefit achieved by such companies in the event of a decision to use the Estonian CIT taxation option would be not only to systematize the issue of potential business development, but also to reduce the tax burden imposed on sole proprietorships by the regulations of the Polish Deal.

Regardless of the above, it is worth noting that the Polish lump sum on company income is still far from its Estonian prototype, especially when it comes to the simplicity of operation and the number of reporting obligations. It still does not explicitly follow from the provisions, inter alia, How should the income from the transformation of companies be documented (in such a situation, should a zero declaration be submitted on the CIT / KW form?). As a result, it seems that possible regulatory deficiencies will be explained by the practice of tax authorities, as irrespective of the numerous reporting obligations, one may hope that soon we will notice a significant increase in the number of taxpayers choosing this form of taxation, due to the fact that the alternative for Estonian CIT it is in practice to pay higher taxes than in 2021.

Źródło: https://www.rp.pl/podatki/art35911101-estonski-cit-w-praktyce

Katarzyna Zadroga

18 May 2022

You may be interested:

Tax

[EVENT] WINE & TAX. Let’s talk business after hours ALTOgether

Let’s talk business after hours #ALTOgether Will you grow old before KSeF comes into force? You are a decision-maker? How ...

Read more

Tax

[ALERT ALTO]: Latest updates of the National e-Invoicing System (KSeF) are available on the Ministry of Finance website, along with FAQs.

We would like to inform you that the website of the Ministry of Finance has published a section of questions and answers concernin...

Read more